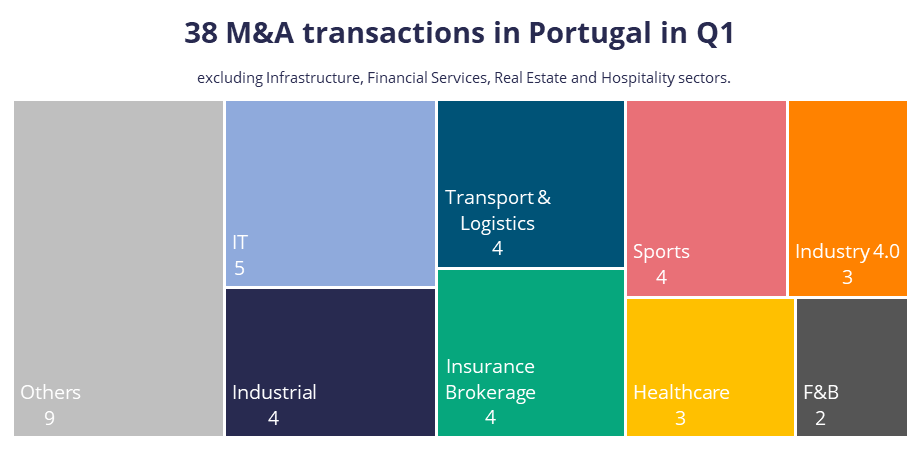

The first quarter of 2025 recorded a total of 38 transactions in Portugal, with notable activity in the IT sector with 5 delas, Industrial, Transport & Logistics, Sports and Insurance Brokerage sectors, each registering 4 transactions. The Industry 4.0 and Healthcare sectors reported 3 transactions each, while the F&B sector recorded 2 deals.

A total of 20 cross-border transactions were recorded, with notable highlights in various sectors. In the HVAC sector, the acquisition of Globalcold by Syclef (an investment vehicle of the French private equity firm Ardian, which manages over €100 billion in assets) stands out. In the Industrial sector, it is worth noting the purchase of GramPerfil, a producer of metal profiles, by Companhia Siderúrgica Nacional, and the acquisition of Cerisol, a manufacturer of ceramic insulators, by Insulation Technology Group. In the Healthcare sector, we highlight the acquisition of Edol by Faes Farma (a company listed on the Spanish stock exchange). Lastly, in the Transport & Logistics sector, we highlight the purchase of Grupo Totalmédia by Renhus Group (a German logistics and transport group with a global presence).

Private equity firms and their investment vehicles were responsible for 13 transactions. Of these 13 deals, 3 took place in the Insurance Brokerage sector, including the acquisition of NacionalGest by Atena Equity Partners, marking the first investment of its new €60 million fund (Atena III). In the F&B sector, ActiveCap acquired Fabridoce, a producer of traditional Portuguese sweets, including “ovos moles”. In the Industrial sector, Core Capital announced the acquisition of 51% of Bolseira for €9.5 million. Lastly, AVK (an investment vehicle of Crest Capital Partners and HCapital) acquired Pixel Light Audiovisuals in the Audiovisual sector.

The two largest transactions in this quarter were led by Portuguese groups. In the Healthcare sector, CUF acquired the Grupo HPA Saúde, which operates 5 hospitals and 17 clinics in the Algarve, Alentejo, and Madeira regions. In the IT Consulting sector, NOS acquired Claranet.

Note: Transactions in the Infrastructure, Financial Services, Real Estate, and Hospitality sectors were excluded from this analysis.

| Sector | Target | Acquirer | Country | Investor type |

|---|---|---|---|---|

| Industrials | Bolseira (51%) | Core Capital | Portugal | PE/PE backed |

| Industrials | GramPerfil | Companhia Siderúrgica Nacional | Brazil | Strategic |

| Industrials | Beyond Composite | Sonae Capital | Portugal | PE/PE backed |

| Industrials | Cerisol – Isoladores Ceramicos | Insulation Technology Group (PHI Industrial) | Germany | PE/PE backed |

| Transport & Logistics | INOV Logistics | Six Overseas Transport Solutions | Portugal | Strategic |

| Transport & Logistics | RIA Transportes | Grupo MCoutinho | Portugal | Strategic |

| Transport & Logistics | Moove+ Portugal | Marcelo Sicsu (MBO) | Portugal | Private investor |

| Transport & Logistics | Grupo Totalmédia | Rhenus Group | Germany | Strategic |

| IT | Prologica | Glintt Global | Portugal | Strategic |

| IT | Claranet Portugal | NOS | Portugal | Strategic |

| IT | BIMMS – BIM Management Solutions | CTS Group SA | Switzerland | Strategic |

| IT | F5IT – Tecnologias de Informação | Seresco | Spain | Strategic |

| IT | PHC Software | Cegid | Portugal | Strategic |

| Insurance Brokerage | Safe-Crop | Schweizer Hagel | Switzerland | Strategic |

| Insurance Brokerage | Vitorinos Seguros | PIB Group (Apax Partners e The Carlyle Group) | UK | PE/PE backed |

| Insurance Brokerage | José Teixeira Seguros | Universalis Acrisure | USA | PE/PE backed |

| Insurance Brokerage | NacionalGest | Atena Equity Partners | Portugal | PE/PE backed |

| Industry 4.0 | Stoneshield – Engineering | Lear Corporation | USA | Strategic |

| Industry 4.0 | Sentinel | Mondragon | Spain | Strategic |

| Industry 4.0 | Neadvance | Atlas Copco | Sweden | Strategic |

| Healthcare | Edol | Faes Farma | Spain | Strategic |

| Healthcare | Grupo HPA Saude Private Health | CUF Descobertas Hospital | Portugal | Strategic |

| Healthcare | MD Clínica | Hospitais Privados de Portugal SGPS | Portugal | PE/PE backed |

| Sports | FC Alverca Futebol SAD | Vinícius Júnior | Brazil | Private investor |

| Sports | C. D. Tondela | Elite Management and Administration Group | Spain | Strategic |

| Sports | AD Sanjoanense | AMNCO – Proyetos y Inversiones | Colombia | Strategic |

| Sports | Balance Company | Growth Partners Capital | Portugal | PE/PE backed |

| F&B | Fabridoce | ActiveCap | Portugal | PE/PE backed |

| F&B | Terra do Bacalhau | Firmar – Comercio De Bacalhau, Unipessoal | Portugal | Strategic |

| Others | Globalcold | Syclef (Ardian) | France | PE/PE backed |

| Others | Pixel Light Audiovisuals | AVK (Crest Capital Partners e Hcapital) | Portugal | PE/PE backed |

| Others | Engidro Engineering Solutions | S317 Consulting (Touro Capital Partners) | Portugal | PE/PE backed |

| Others | Piquet Realty Portugal | Porta da Frente Christie’s | Portugal | Strategic |

| Others | Zualliance | IskayPet Group | Spain | Strategic |

| Others | Tap My Back | CultureBoost | USA | Strategic |

| Others | Bondhabits | Loba | Portugal | Strategic |

| Others | Bébécar UK | Baby Central | UK | Strategic |

| Others | Calvelex – Indústria De Confecções | Nord Solarimi, BPF | Portugal | Strategic |