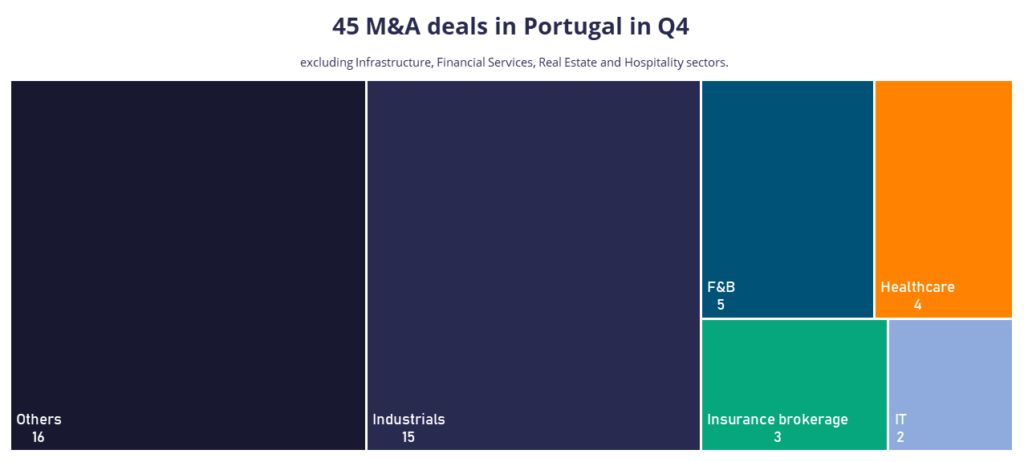

The Portuguese M&A market recorded 45 transactions in the fourth quarter of 2025, with a strong activity in the Industrials sector, which accounted for 15 deals, and in the F&B sector, with 5 transactions. Of the total number of transactions, 31 were led by domestic investors, and 28 by private equity funds or their portfolio companies.

Within the universe of Portuguese private equity funds, Oxy Capital stands out with three distinct transactions: a capital increase in the construction waste management company Costa Almeida Ambiente, an investment exceeding 14 million euros in the olive sector, and the divestment of its stake in the door manufacturer Cicomol to the Swiss group Arbonia. ActiveCap also deserves mention for its investments in T&T, PMH, and Natstone, companies specialized in billing software, medical device supply, and natural stone processing, respectively. Draycott launched the industrial laundry brand Claro, resulting from the merger of VivaWashing, Staro, and NovaWash/SerlimaWash II. CoRe Capital also created an investment platform in the rehabilitation clinic sector through the acquisition of Moveclinics and Grupo Costa Maia. Finally, other key transactions include Vallis Capital Partners’ acquisition of 65% of Ceramirupe Ceramics, a manufacturer of utility and decorative stoneware, and the innovative acquisition of metalworking company Inocambra, involving Menlo Capital (50%) and the company’s employees (50%) through the “Somos Acionistas” program.

On the other hand, international companies completed 14 acquisitions in Portugal, being responsible for the largest deals of the quarter. Key transactions include the sale of Secil for 1.4 billion euros to the Spanish company Cementos Molins and the sale of Frulact for 600 million euros to the Italian company Nexture. Other notable deals include the sale of the IGM Group to Selena, which integrated sandwich panel manufacturers Irmalex, Temopainel, and Erfi, a 17.3 million euros capital increase in Impresa by MFE, the sale of 70% of electrical services provider EST to the French company Vulcain Engineering, and the sale of Acail Gás to Linde.

Domestically, other Portuguese investors also stood out, such as Grupo Arié and Incormate, which acquired Multilem, a company specializing in event stands. Brisa also acquired AtoBe, a company that develops and manufactures toll collection equipment and road mobility solutions. There was also significant consolidation in the Top 10 insurance brokerage segment, with MDS acquiring 50.1% of Seguramos. In the food sector, Jerónimo Martins acquired the fruit and vegetable group Luís Vicente, while Cerealis and Better Foods merged their respective milling operations.

Finally, it is worth highlighting some notable acquisitions by Portuguese companies abroad. Poultry group Lusiaves acquired a majority stake in the Spanish group Oblanca, which has a turnover exceeding 120 million euros, and Grupo Casais acquired the production unit of the Spanish company Terratest, an operator in the field of special foundations and soil improvement.

Note: Transactions in the Infrastructure, Financial Services, Real Estate, and Hospitality sectors were excluded from this analysis.

| Sector | Target | Acquirer | Country | Type of Investor |

|---|---|---|---|---|

| Industrials | Valbopan | Oakspire | Portugal | Strategic |

| Industrials | VIROC | Oakspire | Portugal | Strategic |

| Industrials | Acail Gás | Linde | Germany | Strategic |

| Industrials | Inocambra | Menlo Capital / “Somos Acionistas” | Portugal | PE/PE backed |

| Industrials | Cicomol | Arbonia | Switzerland | Strategic |

| Industrials | Ibera | CIMPOR | Portugal | Strategic |

| Industrials | Ceramirupe Cermicas (65%) | Vallis Capital Partners | Portugal | PE/PE backed |

| Industrials | Cozinhas Micra | Luís Serzedelo and Frederic Messerschmitt | Portugal | PE/PE backed |

| Industrials | VivaWashing | Claro (Draycott) | Portugal | PE/PE backed |

| Industrials | Staro | Claro (Draycott) | Portugal | PE/PE backed |

| Industrials | NovaWash/SerlimaWash II | Claro (Draycott) | Portugal | PE/PE backed |

| Industrials | PMH – Produtos Médicos-Hospitalares | ActiveCap | Portugal | PE/PE backed |

| Industrials | Secil | Cementos Molins | Spain | Strategic |

| Industrials | Natstone | ActiveCap | Portugal | PE/PE backed |

| Industrials | IGM Group | Selena Group | Poland | Strategic |

| F&B | Luís Vicente | Jerónimo Martins | Portugal | Strategic |

| F&B | Frulact | Nexture | Italy | PE/PE backed |

| F&B | Viveiros do Coura | Caviar Pirinea | Spain | Strategic |

| F&B | Cerealis Moagens / Better Foods (Moagens) | Fusão | Portugal | PE/PE backed |

| F&B | Fração Campestre / Terralivae | Oxy Capital | Portugal | PE/PE backed |

| Healthcare | Júlio Teixeira | Amethyst Healthcare | Netherlands | PE/PE backed |

| Healthcare | Oftalmocenter | Miranza (Veonet) | Spain | PE/PE backed |

| Healthcare | Moveclinics | Core Capital | Portugal | PE/PE backed |

| Healthcare | Grupo Costa Maia | Moveclinics (Core Capital) | Portugal | PE/PE backed |

| Insurance brokerage | BR Seguros | Sabseg | Portugal | PE/PE backed |

| Insurance brokerage | Elísioseguros | VCS – Verspieren | Portugal | Strategic |

| Insurance brokerage | Seguramos (50%) | MDS | Portugal | PE/PE backed |

| IT | T&T – Telemática e Tecnologias de Informação | ActiveCap | Portugal | PE/PE backed |

| IT | Goma Design | EveryMatrix | UK | Strategic |

| Others | Costa Almeida Ambiente | Oxy Capital | Portugal | PE/PE backed |

| Others | Sebastião & Associados, SROC | DFK & Associados | Portugal | PE/PE backed |

| Others | Pedro Miguel Brito, Patrícia Cardoso Da Silva & Associados | DFK & Associados | Portugal | PE/PE backed |

| Others | António Baptista, Elísio Quintas e Lino Vieira | DFK & Associados | Portugal | PE/PE backed |

| Others | Pontes Baptista & Associados, SROC | DFK & Associados | Portugal | PE/PE backed |

| Others | Romão & Vicente SROC | DFK & Associados | Portugal | PE/PE backed |

| Others | TUU – Building Design Management | C2 Capital Partners | Portugal | PE/PE backed |

| Others | Condsafe | LDC Group | Portugal | PE/PE backed |

| Others | DualTickets (30%) | Crest Capital Partners | Portugal | PE/PE backed |

| Others | AtoBe Mobility Technology | Brisa | Portugal | Strategic |

| Others | Impresa (32,9%) | MFE – Media For Europe | Italy | Strategic |

| Others | EST – Empresa de Serviços Técnicos (70%) | Vulcain Engineering | France | PE/PE backed |

| Others | Zu – Produtos e Serviços para Animais | Musti Group | Finland | Strategic |

| Others | Legionella Prevention | Veolia Portugal | France | Strategic |

| Others | Watercare | Veolia Portugal | France | Strategic |

| Others | Multilem | Arié / Incormate | Portugal | Strategic |

M&A deals of Portuguese companies abroad

| Sector | Target | Acquirer | Country | Type of Investor |

|---|---|---|---|---|

| F&B | Oblanca | Lusiaves | Spain | Strategic |

| Industrials | Terratest (Production Facility) | Grupo Casais | Spain | Strategic |