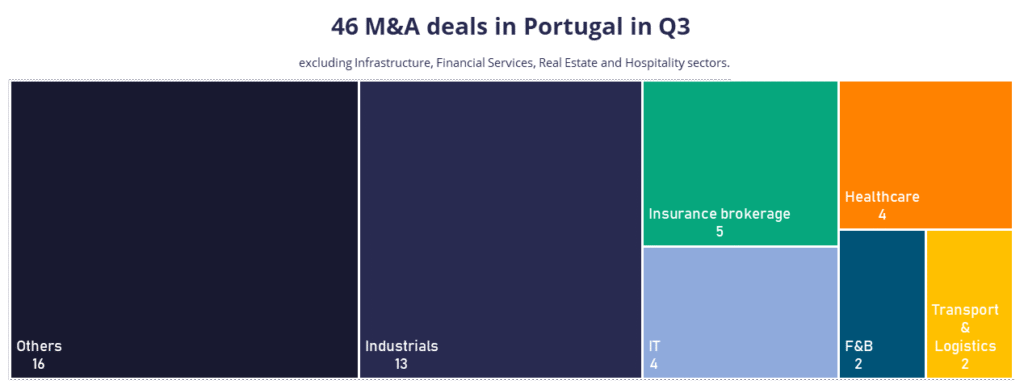

The M&A market in Portugal recorded 46 transactions in the third quarter of 2025, 10 more than in the previous quarter, with greater activity in the Industrials sector (13 deals), Insurance Brokerage (5 deals), as well as in Healthcare and IT, both with 4 deals each.

Private equity funds and their portfolio companies were responsible for 25 transactions. Among them, Crest Capital stood out with the acquisitions of Cubotónic, Precisão Laser, and Alcorsal, companies specializing in metalworking, metal cutting, and metal treatment and coating, respectively. Conversely, it sold Auto Delta to Spanish private equity firm Portobello Capital. Oxy Capital acquired Alital, an office chair manufacturer, and took a 25% stake in Brasmar. Also in the furniture manufacturing sector, HCapital acquired Italbox, specialized in bathroom furniture, shower screens, and mirrors, while ActiveCap bought Ozo Living, focused on custom-made furniture. In the tourism sector, Core Capital entered the tourist accommodation segment with the acquisition of Lisbon Serviced Apartments, which manages 342 short-stay units, while Atena Equity Partners acquired Buzz DMC, one of the largest destination management agencies in Portugal. Following its entry into NacionalGest in the first quarter this year, Atena Equity Partners carried out four additional add-ons in insurance brokerage, namely Beira Dinâmica, ANR Mediação de Seguros, ROQ, and JNS. Also this quarter, Unisana Hospitals, a joint venture between Atena and 3T Portugal, added Hospital da Ordem Terceira do Chiado to its portfolio, now generating over 40 million euros in revenues. On the divestment side, Atena sold its entire stake in Science4You to the current management team. Finally, UK-based Arrow Group acquired Engexpor (project and construction management) and Transfor (engineering and construction).

The largest transactions by strategic buyers were mostly led by international groups. Distriplac, a construction materials distributor controlled by Saint-Gobain, acquired Liveplace, a company with 47 million euros in revenue. The German-Austrian Lohmann & Rauscher acquired 49% of Albino Dias de Andrade (ADA), a manufacturer of gauze, bandages, and incontinence products with 34 million euros in turnover. French group Legrand, specialized in electrical infrastructure, bought Quitérios, a manufacturer of electrical equipment with 17 million euros in revenues. Meanwhile, Spanish Plexus Tech acquired BI4ALL, a Portuguese firm specialized in data strategy, analytics, and artificial intelligence.

At the national level, Portuguese companies were also active. Tekever, a national unicorn, acquired Cocoon Experience, focused on user experience consulting. In the transport and logistics sector, CTT acquired Decopharma, specialized in logistics for the pharmaceutical and healthcare industries, while Grupo Sousa purchased Tirgal, a maritime transport company. Salvador Caetano Group acquired Hyundai and Nissan dealerships and workshops in Loures, while Deloitte Legal integrated Telles law firm. Media Capital entered the newspaper segment with the acquisitions of Nascer do Sol and i.

It is also worth highlighting several significant international acquisitions led by Portuguese companies. Altri acquired a majority stake in AeoniQ, a company specialized in developing sustainable textile fibers. Semapa purchased Spain’s Imedexa for 148 million euros, a producer of metal structures for power transmission and distribution infrastructure. Vangeste strengthened its presence in mold-making and plastic injection for the medical industry with the acquisition of UK-based Micro Systems and Optimold. In food and beverages, Casa Redondo acquired the Sheridan’s liqueur brand, while Officetotal Food Brands acquired the Chipicao brand for the Portuguese, Spanish, and French markets. Finally, Brisa Group moved forward with the acquisition of Axxès, a provider of electronic toll services for heavy vehicles.

Note: Transactions in the Infrastructure, Financial Services, Real Estate, and Hospitality sectors were excluded from this analysis.

| Sector | Target | Acquirer | Country | Type of Investor |

|---|---|---|---|---|

| Industrials | Quitérios | Legrand | France | Strategic |

| Industrials | Sanindusa (10%) | Famílias Amaro, Batista, Oliveira e Veiga | Portugal | Strategic |

| Industrials | ADA (49%) | Rau-Be Beteiligungen | Germany | Strategic |

| Industrials | Italbox (75%) | HCapital | Portugal | PE/PE backed |

| Industrials | Alital | Oxy Capital | Portugal | PE/PE backed |

| Industrials | Liveplace | Distriplac (Saint Gobain) | France | Strategic |

| Industrials | Asportuguesas | Kyaia | Portugal | Strategic |

| Industrials | Cubotónic | Crest Capital | Portugal | PE/PE backed |

| Industrials | Precisão Laser | Crest Capital | Portugal | PE/PE backed |

| Industrials | Alcorsal | Crest Capital | Portugal | PE/PE backed |

| Industrials | Soplacas | Família Mota Gaspar | UK | PE/PE backed |

| Industrials | Transfor | Arrow Group | Portugal | PE/PE backed |

| Industrials | Ozo Living | ActiveCap | Portugal | PE/PE backed |

| Insurance brokarage | João Marques e Paulo Sousa – Consultor de Seguros | Sabseg (Miura) | Portugal | PE/PE backed |

| Insurance brokarage | Beira Dinâmica | NacionalGest / Atena (Add-on) | Portugal | PE/PE backed |

| Insurance brokarage | ANR Mediação de Seguros | NacionalGest / Atena (Add-on) | Portugal | PE/PE backed |

| Insurance brokarage | ROQ | NacionalGest / Atena (Add-on) | Portugal | PE/PE backed |

| Insurance brokarage | JNS | NacionalGest / Atena (Add-on) | Portugal | PE/PE backed |

| Health | Grupo Hospitalar das Beiras | Luz Saúde / C2 MedCapital | Portugal | PE/PE backed |

| Health | Hospital Escola Fernando Pessoa | Trofa Saúde | Portugal | Strategic |

| Health | Luz Saúde (40%) | Macquarie | Australia | PE/PE backed |

| Health | Hospital da Ordem Terceira do Chiado | Unisana Hospitais (Atena, 3T) | Portugal | PE/PE backed |

| IT | BI4all | Plexus Tech | Spain | Strategic |

| IT | Host Hotel Systems | Banyan Software | USA | Strategic |

| IT | Emotion Mobility | PSG Equity | USA | PE/PE backed |

| IT | Cocoon Experience | Tekever | Portugal | PE/PE backed |

| F&B | Brasmar (25%) | Oxy Capital | Portugal | PE/PE backed |

| F&B | Decorgel | Credin Portugal (Orkla Food Ingredients) | Norway | Strategic |

| Transport & Logistics | Decopharma | CTT | Portugal | Strategic |

| Transport & Logistics | Tirgal | Grupo Sousa | Portugal | Strategic |

| Others | Resinoflorestal e Transfer | Biozêzere, Ambiflora (Crest), Pedro e Filomena Ferreira | Portugal | PE/PE backed |

| Others | Newcar | ExpressGlass | Portugal | Strategic |

| Others | Concessionários da Hyundai e Nissan | Salavador Caetano | Portugal | Strategic |

| Others | Engexpor | Arrow Group | UK | PE/PE backed |

| Others | COEM | Mecwide | Portugal | Strategic |

| Others | Nascer do Sol e I | Media Capital | Portugal | Strategic |

| Others | Lisbon Serviced Apartments | Core Capital | Portugal | PE/PE backed |

| Others | Grudisul, Alcigarve, Tabacaria L. Lisboa e Sobral&Renato | Grupo Bel | Portugal | Strategic |

| Others | Sanifauna | Nuzoa | Spain | PE/PE backed |

| Others | Auto Delta | Portobello Capital | Spain | PE/PE backed |

| Others | Gymnasium | VivaGym | Spain | PE/PE backed |

| Others | Climex | Serlima | Portugal | Strategic |

| Others | Buzz DMC | Atena Equity Partners | Portugal | PE/PE backed |

| Others | Clínica Vetrinária 115 Animal, Grupo SOSVET, Clínica Veterinária do Castêlo | IVC Evidensia | UK / Sweden | Strategic |

| Others | Telles | Delloite | Portugal | Strategic |

| Others | Science4You | MBO | Portugal | Strategic |

M&A deals of Portuguese companies abroad

| Sector | Target | Acquirer | Country | Type of Investor |

|---|---|---|---|---|

| Industrials | AeoniQ (59%) | Altri | Switzerland | Strategic |

| Industrials | Imedexa | Semapa | Spain | PE / PE-Backed |

| Industrials | Micro Systems Ltd e Optimold Ltd | Vangest | UK | PE / PE-Backed |

| F&B | Sheridan’s | Casa Redondo | Ireland | Strategic |

| F&B | Chipicao (Portugal, Espanha e França) | Officetotal Food Brands | Portugal, Spain and France | Strategic |

| Others | Axxès | Grupo Brisa | France | Strategic |

| Others | Mecod | Controlauto | Spain | Strategic |