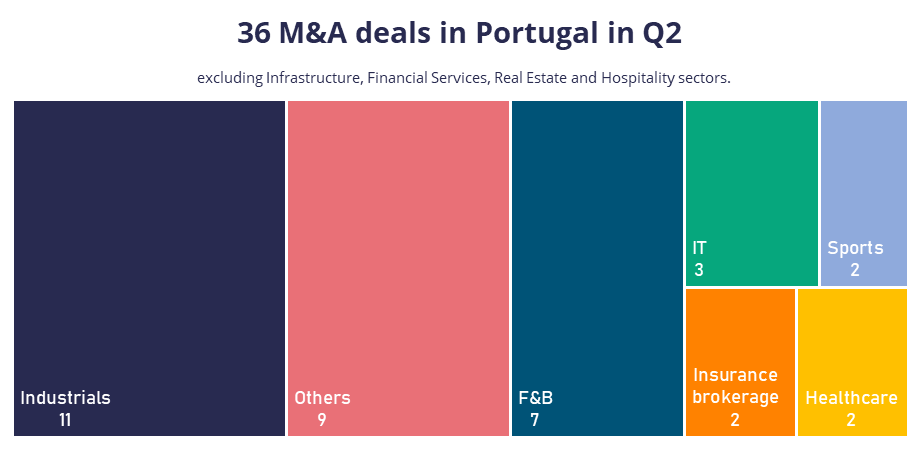

During the second quarter of 2025, a total of 36 transactions were recorded in Portugal. The most dynamic sectors during this period were Industrial with 11 transactions, the Food & Beverage (F&B) sector with 7 transactions, while the Insurance Brokerage and the Sports sectors remained hot, each with 2 transactions.

The largest transactions were led by strategic companies from the Iberian Peninsula. In the automotive sector, Salvador Caetano Group invested in motorcycles by acquiring 75% of Multimoto, a company that, in 2023, recorded a turnover exceeding 53 million euros across Portugal and Spain. In the food sector, the Portuguese chain “A Padaria Portuguesa,” with 84 stores and two production units, was fully acquired by the Spanish group Rodilla, controlled by the brewery Damm. In the industrial sector, Concremat, the national leader in precast concrete with an annual turnover of 52 million euros in 2024, was acquired by the Spanish company Cementos Molins, specialized in the production of aggregates, cement, and concrete.

Investment funds and their respective vehicles carried out 21 transactions. Cedrus Capital acquired iPlastika, a company operating in plastic injection, automotive lighting, and mould manufacturing for the automotive sector and MCH Private Equity acquired a minority interest in Sanfil Medicina, a company that owns 3 hospitals and six clinics in the Center of Portugal. Through BPF’s Programa Capitalizar Fund, Touro Capital made two investments, namely in the agro-industrial company Pasto Alentejano and in the brick manufacturing company Cerâmica de Pegões. Conversely, Crest Capital Partners divested two portfolio companies from its first fund: Irmarfer group, a manufacturer of metal structures for events, that was sold to the Spanish Adapta Capital; and Queijos Tavares group, a cheese producer, that was sold to the French group Lactalis, the world leader in the dairy sector. Also noteworthy is the MBO of the two fashion brands from the Sonae Group, MO and Zippy, supported by Oxy Capital.

Among other relevant transactions, the acquisition of the seedless grape producer Vale da Rosa stands out, with the Spanish companies Iberian Premium Fruits and Sanlucar Fruits investing 3.5 million euros in the company, which is currently undergoing a Special Revitalization Process. Additionally, 51% of the capital of M2Bewear (the company behind the iconic Portuguese shoe brand Sanjo) was sold to the entrepreneur Carlos Palhares.

It is also worth mentioning some significant acquisitions led by Portuguese companies abroad. Firstly, Draycott, together with Movendo (owned by Sociedade Francisco Manuel dos Santos), acquired the French company Verescence, a manufacturer of glass packaging for the luxury cosmetics sector, in a deal valued at 490 million euros. Next, CTT acquired the Spanish company CACESA, specialized in international e-commerce, valuing its assets at 91 million euros. In the plastics sector, Atena Equity Partners and Core Capital, through its portfolio company Plastrofa, acquired the Spanish company Manufacturas Polisac, a manufacturer of technical bags, creating an Iberian group with a turnover exceeding 24 million euros. Lastly, Feedzai, the Portuguese unicorn specializing in the detection and prevention of financial fraud, acquired the Australian company Demyst, a leader in providing internal and external business data, for approximately 100 million dollars.

Note: Transactions in the Infrastructure, Financial Services, Real Estate, and Hospitality sectors were excluded from this analysis.

| Sector | Target | Acquirer | Country | Investor type |

|---|---|---|---|---|

| Industrials | Concremat | Cementos Molins | Spain | Strategic |

| Industrials | Irmarfer | Adapta Capital | Spain | PE/PE backed |

| Industrials | M2Bewear (Sanjo) | Head Value | Portugal | PE/PE backed |

| Industrials | Coindu (fábrica) | Nexteam | France | PE/PE backed |

| Industrials | iPlastika | Cedrus Capital | Portugal | PE/PE backed |

| Industrials | BB&G (Advanced Tyre Pyrolysis) | BDI-BioEnergy International, JR New Horizons, Prismore Capital | Austria | PE/PE backed |

| Industrials | ABP Impex | M.R. Organisation | India | Strategic |

| Industrials | Advanced Cyclone Systems | Priveq Investment, Sunds Fibretech | Sweden | PE/PE backed |

| Industrials | Plastrofa – Plásticos da Trofa (minority stake) | Core Capital | Portugal | PE/PE backed |

| Industrials | Cerâmica de Pegões J. G. Silva | Touro Capital Partners | Portugal | PE/PE backed |

| Industrials | CaetanoBus | Setlima – Investments and BPF | Portugal | PE/PE backed |

| F&B | Couto & Brandão | Panike | Portugal | Strategic |

| F&B | Quejos Tavares | Parlamat (Lactalis) | France | Strategic |

| F&B | Vale da Rosa | Iberian Premium Fruits, Sanlucar Fruits | Spain | PE/PE backed |

| F&B | Padaria Portuguesa | Grupo Rodilla | Spain | Strategic |

| F&B | Aquaterra | Davidson Kempner Capital Management | USA | PE/PE backed |

| F&B | Veracruz Almonds | Inter-Risco | Portugal | PE/PE backed |

| F&B | Pasto Alentejano | Touro Capital Partners | Portugal | PE/PE backed |

| Sports | Moreirense Futebol Clube | Black Knight Football Club Uk | UK | Strategic |

| Sports | Real Sport Clube | Futebol com Força | USA | PE/PE backed |

| IT | Climber RMS | Lead Edge Capital, Revenue Analytics | USA | PE/PE backed |

| IT | WeldNote | ESAB India | India | Strategic |

| IT | Laxton | Dai Nippon Printing | Japan | Strategic |

| Healthcare | Sanfil Medicina (minority stake) | MCH Private Equity | Spain | PE/PE backed |

| Healthcare | Esfera Saúde | Ageas PT | Belgium | Strategic |

| Insurance brokerage | Bring Insurance | Diagonal | Portugal | Strategic |

| Insurance brokerage | Cegrel | NationalGest (Atena Equity Partners) | Portugal | PE/PE backed |

| Others | Multimoto | Salvador Caetano | Portugal | Strategic |

| Others | Leirivolt | TSG Solutions, Group HLD | France | PE/PE backed |

| Others | AddVolt | Carrier Global | USA | Strategic |

| Others | Weddo Living | Loja do Condomínio | Portugal | PE/PE backed |

| Others | Quinta Jets | Opul Jets | UK | Strategic |

| Others | Iberol and Biovegetal | Fortitude Capital, Reagro | Portugal | PE/PE backed |

| Others | AlgarExperience (35%) | Lince Capital | Portugal | PE/PE backed |

| Others | Filtapor | SAPI | Italy | Strategic |

| Others | Modalfa and Zippy | Oxy Capital, Sete Amarelo (MBO) | Portugal | PE/PE backed |

M&A deals of Portuguese companies abroad

| Sector | Target | Acquirer | Country | Investor type |

|---|---|---|---|---|

| Industrials | Verescence | Draycottt e Movendo Capital | Portugal | PE/PE backed |

| Industrials | Manufacturas Polisac | Plastrofa – Plásticos da Trofa | Portugal | PE/PE backed |

| IT | Decide | Henko Partners, Link Consulting | Portugal | PE/PE backed |

| IT | Demyst | Feedzai | Portugal | PE/PE backed |

| Transportation and logistics | CACESA | CTT-Correios de Portugal | Portugal | Strategic |

| Insurance brokerage | SRB Assekuranz Broker | MDS Group | Portugal | Strategic |

| Others | Greenalia Forest | Altri SGPS | Portugal | Strategic |